NEW YORK/SINGAPORE, June 11 (Reuters) —

U.S. Treasury Secretary Scott Bessent departed London on Tuesday after two days of high-stakes trade talks between the U.S. and China, leaving investors cautiously optimistic but still grappling with uncertainty. While both sides pledged to revive last month’s Geneva agreement and lift China’s export restrictions on rare earths, details remain scarce — and markets are responding accordingly.

The latest China trade deal discussions brought some relief to investors, but hopes for a robust and lasting resolution remain tempered. The muted market reaction signals that the U.S.–China trade truce was widely expected and lacks the clarity needed to shift investor sentiment meaningfully. Chinese equities (.SSEC, .CSI300) climbed to near three-week highs, while U.S. stock futures slipped slightly. The dollar edged up, and China’s yuan remained steady.

“This is positive news,” said Mark Dong of Minority Asset Management in Hong Kong. “At least now there’s a bottom line that neither side is willing to cross.” Still, risk assets are likely to remain sensitive to headlines as the devil lies in the details of any China tariffs rollback or broader China deal.

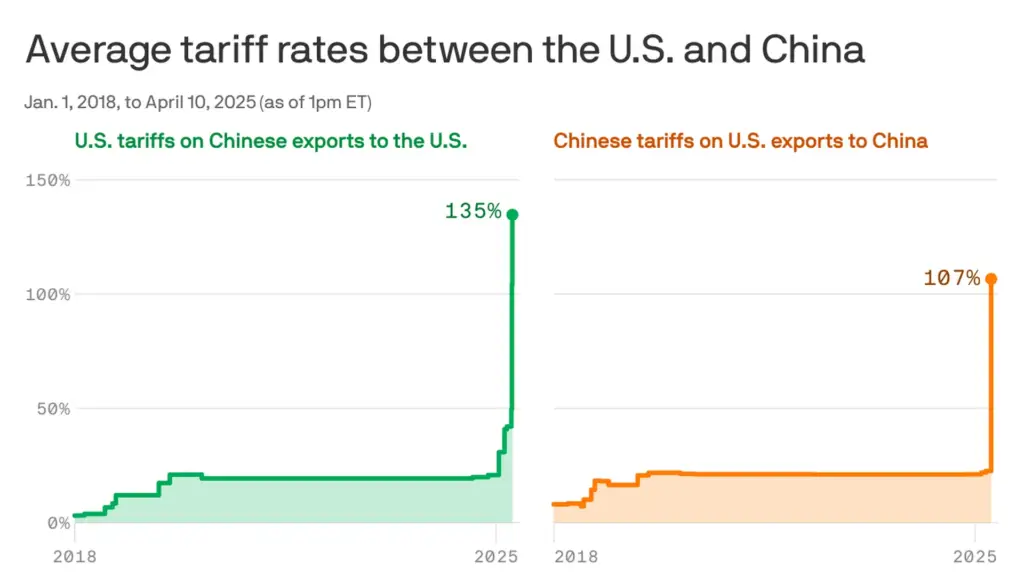

Since President Trump’s controversial “Liberation Day” tariff announcement on April 2 — which rattled markets — a partial reversal has calmed investor fears. The S&P 500 (.SPX) has risen 6.5% since, nearing record highs. However, Chinese stocks have lagged due to persistent concerns about weak consumption, deflation, and overall economic fragility.

Experts warn that the broader U.S.–China trade war — potentially affecting $600 billion in two-way trade — could drag on global growth for months. Phillip Wool of Rayliant Global Advisors noted, “Markets may be underestimating the economic damage already done this year by trade uncertainty. Any rally from a deal may be short-lived.”

For China, a reprieve from tariffs is critical as it battles deflation and sluggish domestic demand. In the U.S., business and consumer confidence have been shaken, with the dollar down over 8% this year amid growing concerns over U.S. fiscal health. President Trump’s China policy, tax cuts, and rising debt burdens continue to weigh on sentiment — all while his administration faces fresh political challenges, including clashes with Elon Musk and immigration protests in Los Angeles.

The stakes for a successful U.S.–China trade deal have never been higher. But for now, investors tracking China trade talks, whether through Reuters, Bloomberg, or Fox Business, remain on edge, unwilling to make bold bets until real progress — and clearer commitments — emerge.