AMD Eyes AI Inference Breakthrough as Investor Confidence Soars

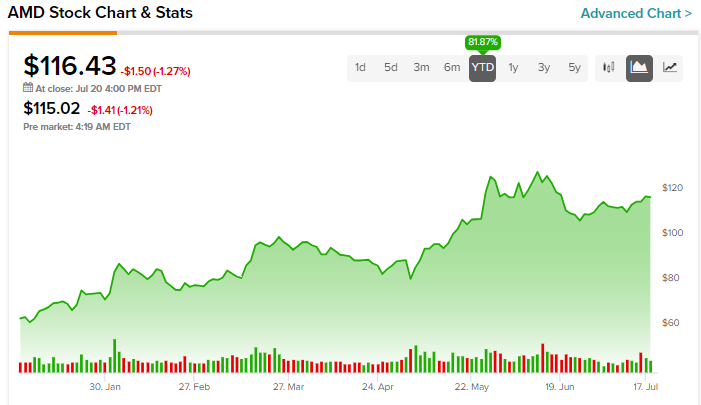

Advanced Micro Devices (NASDAQ: AMD) is facing a major challenge: proving it can capture meaningful market share from Nvidia, the dominant force in the AI and GPU space. Despite the uphill battle, sentiment is shifting in AMD’s favor. The company’s stock has surged nearly 50% since hitting a low two months ago, signaling growing investor confidence after a tough stretch in late 2024 and early 2025.

That optimism is backed by strong fundamentals. AMD recently posted record Q1 2025 earnings, reporting $7.4 billion in revenue and a 54% gross margin. Adding to the momentum is a newly announced $10 billion partnership with Saudi-based AI firm HUMAIN, boosting long-term growth potential.

One respected investor, known online as Stone Fox Capital, sees significant upside ahead—especially as the AI market shifts from training to inference. Citing an expected 80% compound annual growth rate (CAGR) for AI inference, Stone Fox believes the AI accelerator space could balloon into a $500 billion market by 2028. If AMD can secure even 10–20% of that, its data center revenue could hit $50–100 billion in just a few years.

A key part of this thesis lies in AMD’s new MI355x chip, which is poised to outperform Nvidia’s B200 GPU by delivering up to 40% more tokens per dollar. This could position AMD as a disruptive force in the next phase of AI development.

“AMD has the potential to become a powerhouse in AI inference,” says Stone Fox, who maintains a Strong Buy rating.

Wall Street analysts agree. With 22 Buy ratings and 11 Holds, AMD holds a Moderate Buy consensus, and its 12-month average price target of $129.41 reflects an 11% upside.

Disclaimer: This article reflects the views of the featured investor and is for informational purposes only. Always conduct your own research before making investment decisions.