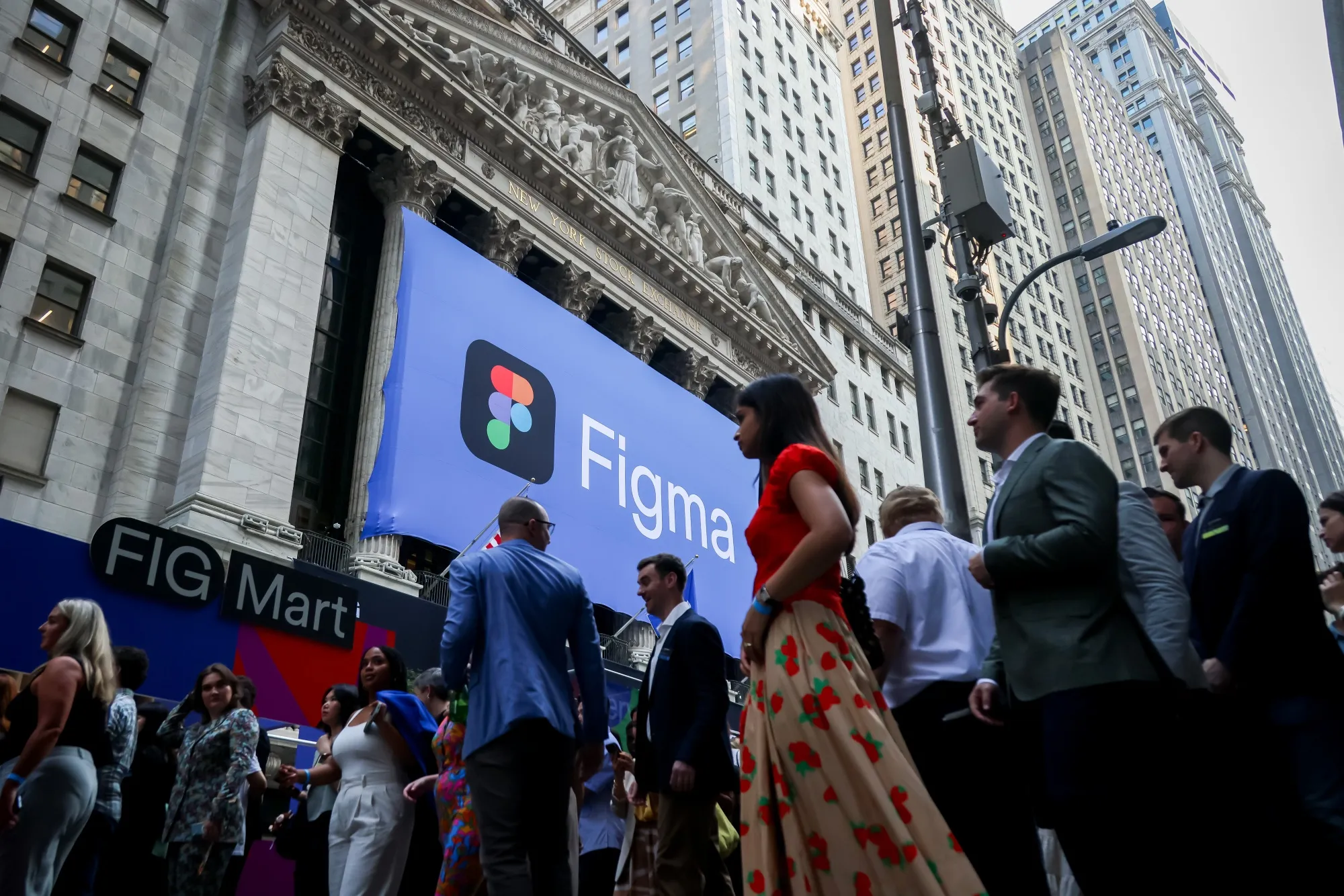

Figma Prices IPO at $33, Beats Expectations and Raises $1.2 Billion Ahead of NYSE Debut

Figma is officially going public—and it’s making a big splash. The design software company priced its IPO at $33 per share, slightly above its projected range of $30 to $32. That extra dollar might seem small, but it reflects strong demand from investors. In total, the IPO raised $1.2 billion, with most of the proceeds going to existing shareholders.

Figma’s stock is set to debut Thursday on the New York Stock Exchange under the ticker symbol “FIG.”

From a $20 Billion Deal to an Independent Future

This IPO comes less than a year after Figma’s planned $20 billion acquisition by Adobe fell apart due to regulatory pushback. Adobe was forced to walk away from the deal and paid a $1 billion breakup fee. Now, Figma is back on its own—and stepping confidently into the public markets.

With a new valuation of $19.3 billion, Figma is hoping to ride the wave of renewed enthusiasm for tech IPOs. Other companies like Circle and CoreWeave have seen strong market debuts this year, signaling a slow but steady revival in the public market for tech stocks.

A Closer Look at Figma’s Growth

Founded in 2012 by Dylan Field and Evan Wallace, Figma has grown into a global company with offices in the U.S., U.K., Germany, Japan, France, and Singapore. Its flagship product—cloud-based design software—has become a go-to tool for product teams and designers worldwide.

According to Figma’s latest financial filing:

- Revenue for the June quarter climbed to $247–$250 million, up 40% from a year ago.

- Operating results for the same quarter range from a modest profit of $2.5 million to a small loss of $500,000—a significant improvement from a $894.3 million loss the year prior, mostly due to stock-based compensation.

- In the March quarter, revenue jumped 46% year-over-year to $228.2 million, with net income tripling to $44.9 million.

Who Owns What in Figma?

Before the IPO:

- CEO Dylan Field holds 56.6 million shares and has voting control over another 26.7 million.

- Index Ventures is the largest institutional investor with 65.9 million shares (17%), followed by Greylock (16%), Kleiner Perkins (14%), and Sequoia Capital (8.7%).

All major shareholders are cashing in by selling a portion of their stakes during the IPO.

What’s Next for Figma?

Now that the Adobe deal is off the table, Figma is charting its own path—and investors clearly believe in the company’s vision. With strong revenue growth, improving profitability, and a massive user base, Figma’s next chapter as a public company is already off to a promising start.

Stay tuned—Figma hits the NYSE floor tomorrow.