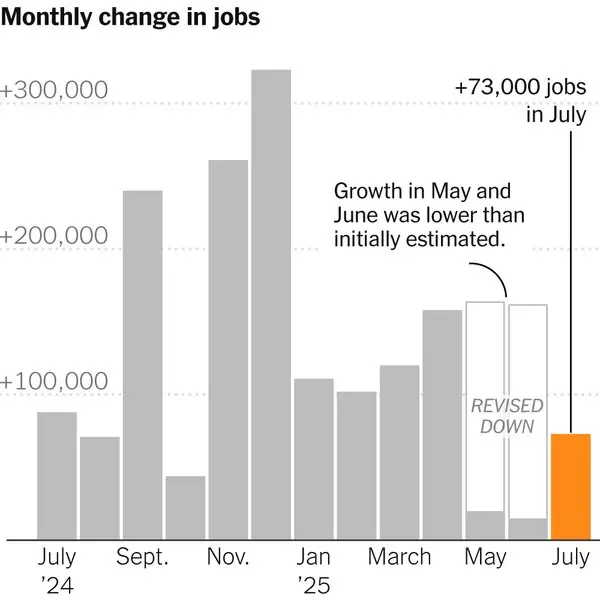

August Jobs Report Shows Labor Market Slowing, Fed Rate Cut Likely

August brought more signs that the U.S. labor market is losing some of its momentum. According to the latest report from the Bureau of Labor Statistics (BLS), job creation sputtered, adding just 22,000 positions for the month — far below economists’ expectations of 75,000. Meanwhile, the unemployment rate ticked up to 4.3%, a signal that the historically strong job market may be starting to soften.

This slowdown follows a revised July increase of 79,000 jobs and a net loss of 13,000 in June, painting a picture of a labor market gradually stalling.

“The job market is stalling short of the runway,” said Daniel Zhao, chief economist at Glassdoor. “August’s report, along with downward revisions, suggests we’re heading into turbulence without the soft landing achieved.”

Despite the weak numbers, financial markets didn’t panic. Stocks opened higher, Treasury yields dropped, and futures traders quickly priced in a 100% chance of a quarter-point Fed rate cut at the Federal Reserve’s September 17 meeting, with even a small chance of a half-point reduction.

The August report also marked the first payrolls count since President Trump fired former BLS Commissioner Erika McEntarfer. McEntarfer’s departure followed the release of July’s weak report and revisions showing reductions in previous months’ job gains. Economist E.J. Antoni, a Trump loyalist, has been nominated to replace her, while William Wiatrowski is serving as acting commissioner.

Even as hiring slowed, wages held steady. Average hourly earnings rose 0.3% for the month, meeting expectations, though the annual gain of 3.7% slightly missed the forecast of 3.8%.

Some sectors bore the brunt of the slowdown. Federal government payrolls fell by 15,000, while health care led gains with 31,000 new jobs, and social assistance added 16,000. Meanwhile, manufacturing and wholesale trade each saw declines of 12,000 jobs.

Economists say the slowdown strengthens the case for a Fed rate cut later this month. “A weaker-than-expected jobs report all but seals a 25-basis-point rate cut,” noted Olu Sonola, head of U.S. economic research at Fitch Ratings. He also pointed to four straight months of manufacturing job losses as evidence that tariff uncertainty may be weighing on hiring.

The report also offered a mixed picture from the household survey. While the employment count increased by 288,000, the number of unemployed rose by 148,000. The labor force participation rate edged up to 62.3%, and the broader unemployment measure, which includes discouraged and part-time workers, climbed to 8.1%, the highest since October 2021.

Looking ahead, the BLS will release its annual benchmark revisions on Tuesday, which may adjust some of these numbers. Revisions have been controversial in recent years, particularly as response rates for surveys have declined. Trump has criticized the BLS as politically biased, making these upcoming revisions a topic of market attention.

In the meantime, the August report paints a labor market that is still expanding but slowing, with potential turbulence ahead for both the economy and Federal Reserve policy.